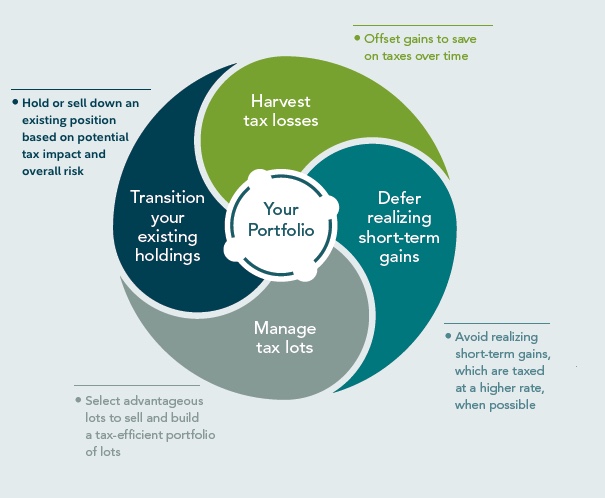

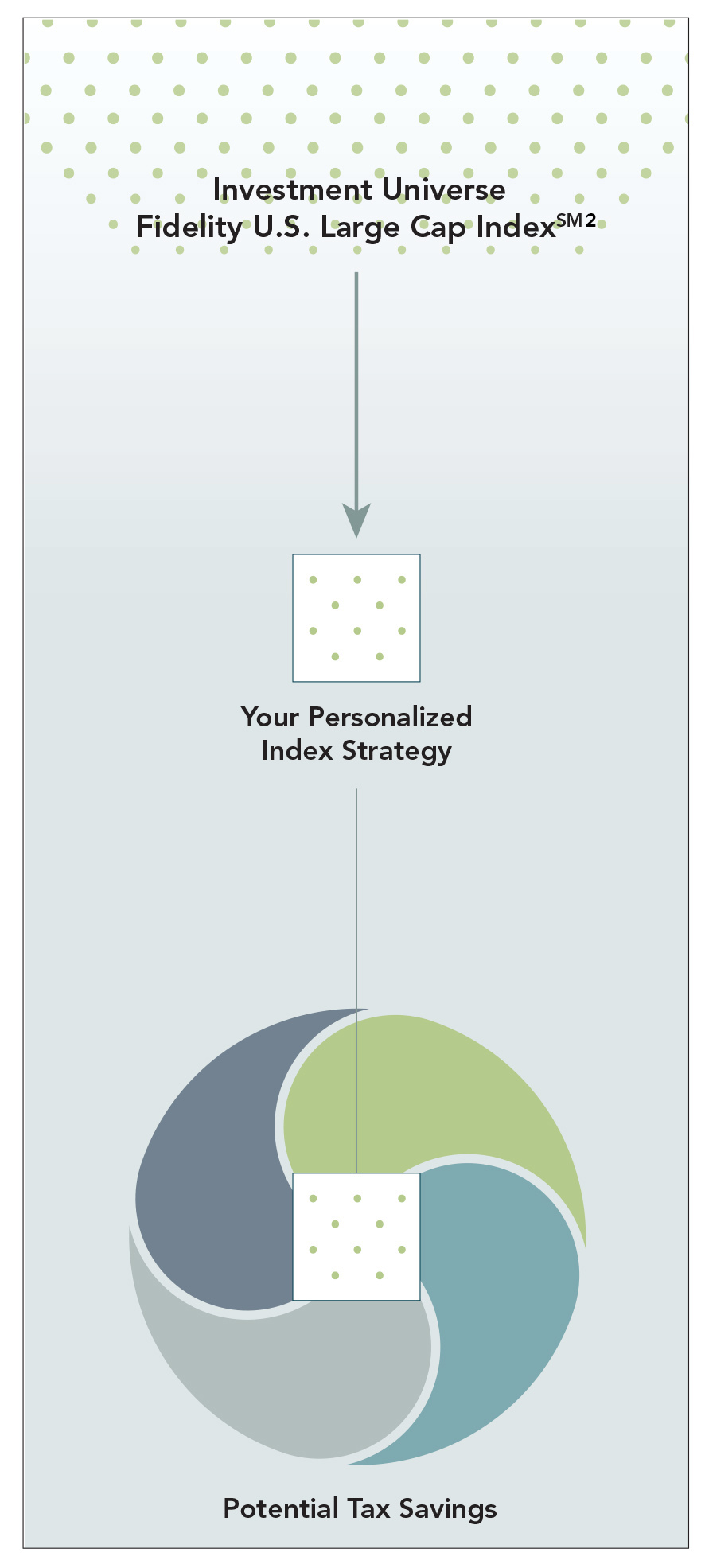

If you arent adding money to buy new tax lots every year then eventually all your holdings will be appreciated and tax loss harvesting wont provide any value for the fees youll incur. To plan with an advisor explore the Fidelity Tax-Managed US Equity Index Strategy or the Fidelity Tax-Managed International Equity Index Strategy Of course this strategy isnt right for everyone.

Advisory services offered by Fidelity Personal and Workplace Advisors LLC FPWA a registered investment.

. Tax-Managed Model Strategy returns. Some Tax Managed Strategies offered by Frontier Asset Management are appropriate for use at the heart of a clients portfolio while others are complementary and help round out an investment portfolio. But in reality its the after-tax returns that matter for taxable investors.

Equity Index Strategy and the Equity Income. Find Out How PIMCOs Tools Resources Can Help Investors Stand Up To Market Challenges. Annual management fees start at 090 for the first 100000 in the account and incrementally decrease for assets above 100000.

1301 Second Avenue 18th Floor Seattle WA 98101. Schwab Managed Portfolios require initial investments of 25000. Schwab SP 500 Index which has a Morningstar Analyst Rating of Gold also has fine long-term tax-efficiency numbers as does the Silver-rated DFA US.

For example Fidelitys Tax Managed US. Ad SMAs that track an equity index while incorporating tax loss harvesting. Many mutual fund companies offer tax-managed funds that hold a variety of different assets such as balanced funds international funds small cap funds and others.

Learn About Our Full Suite Of Funds Today. The Funds benchmark is the MSCI EAFE After-Tax Index. A Global Leader in Tax Managed Portfolios.

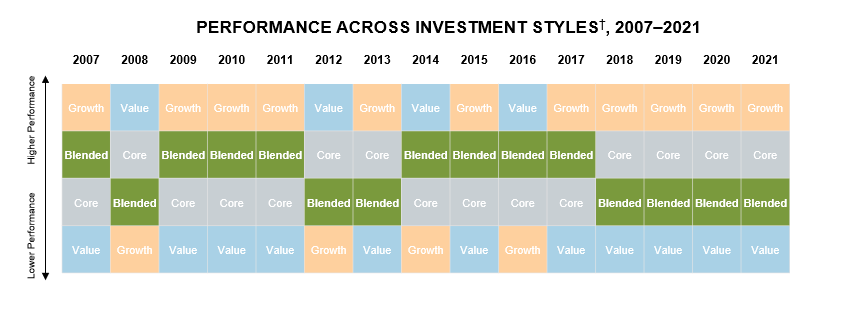

When youre building portfolios and evaluating performance its easy to think in terms of pre-tax returns. 1 A tax liability is the total amount of tax debt owed by an individual corporation or other entity to a taxing authority. Explore our tax managed funds and model strategies designed to maximize after-tax returns.

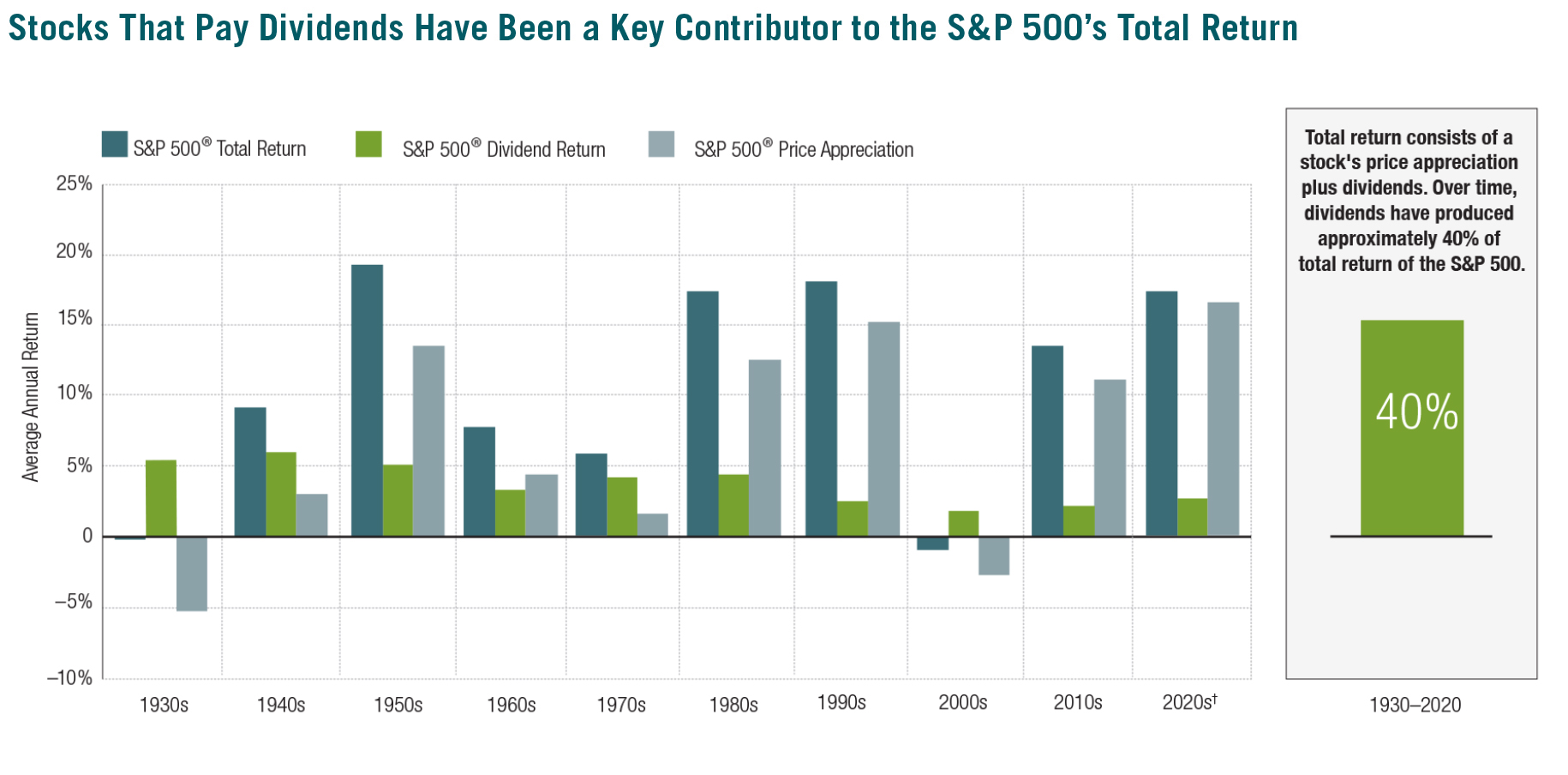

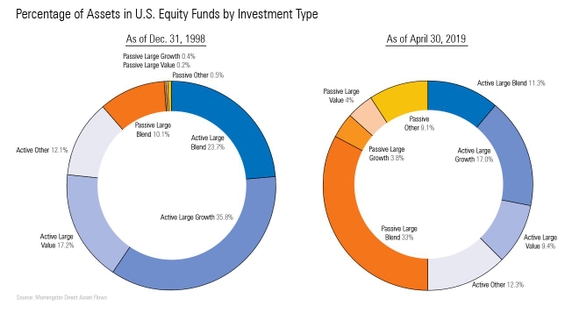

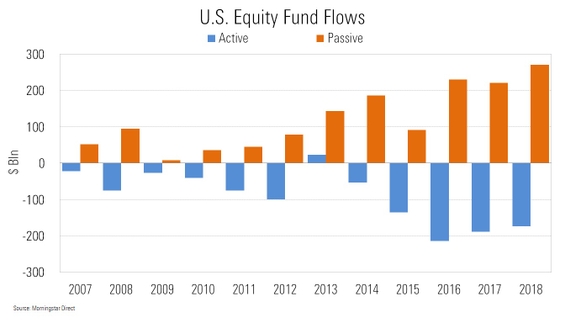

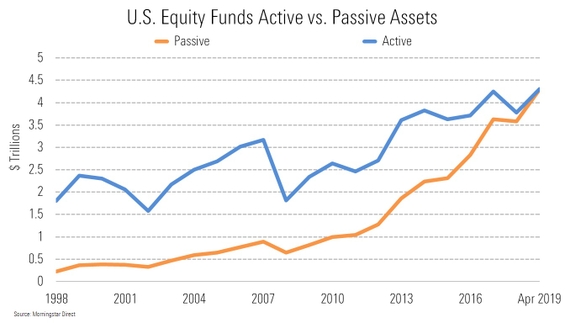

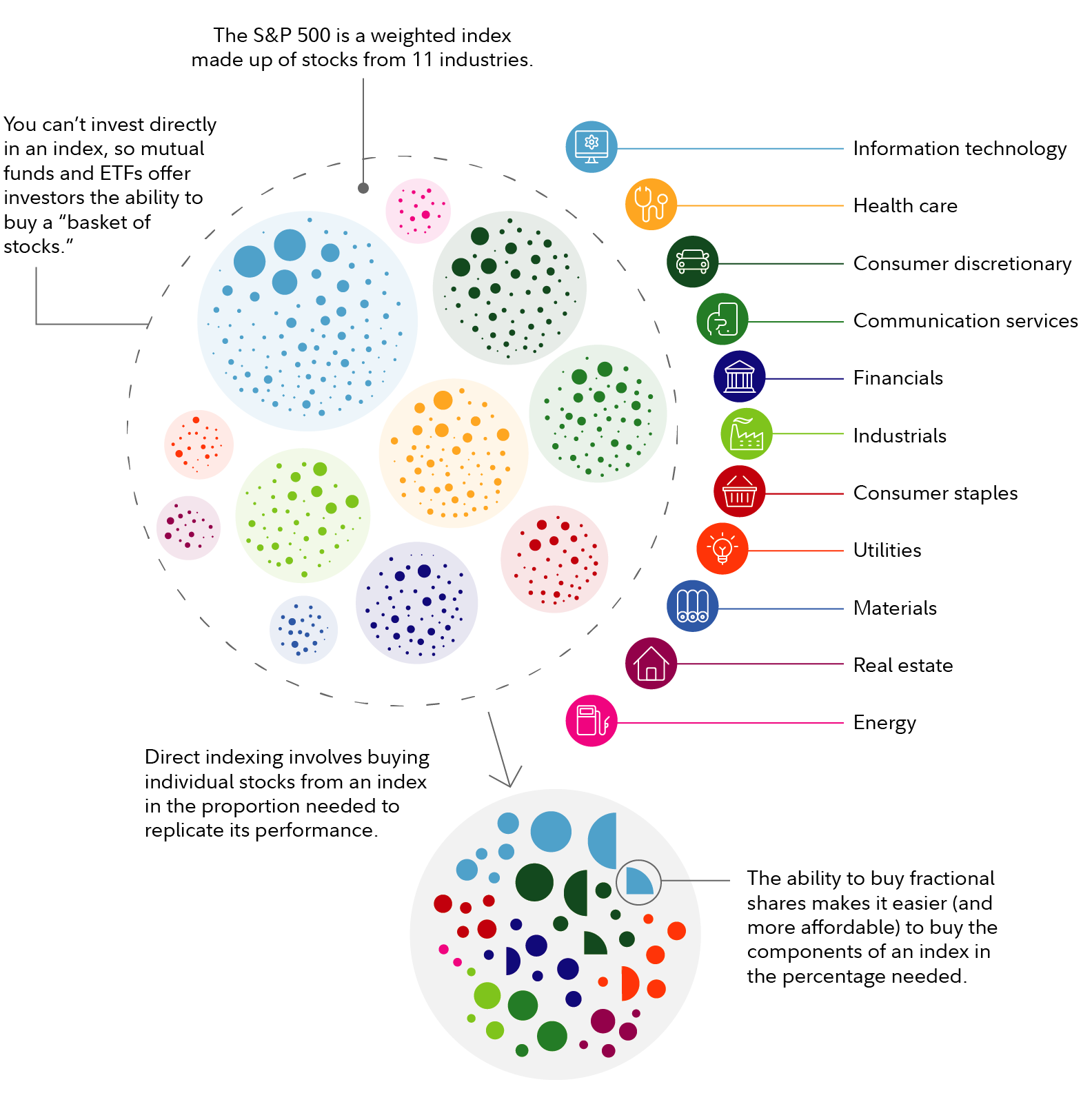

The Funds investment approach is grounded in the Global Equity teams belief that in the short term equity markets exhibit exploitable. Passive is defined as being an index fund as reported by Morningstar or part of an ETF Category. 2 Capital gain is a rise in the value of a capital asset investment or real estate that gives it a higher worth than the purchase price.

Active tax management Your account will be managed on an ongoing basis where one or a combination of tax-smart investing. The GMO Tax-Managed International Equities Fund seeks to generate high after-tax total return by investing primarily in non-US. You can invest in stocks tax-efficiently by choosing the right investment strategies and vehicles so lets get down to brass.

Cash money market funds and accounts CDs checking and savings accounts and so forth. It invests in large cap stocks. ETF strategies hit that point sooner than direct indexing but theres still a point where you dont benefit anymore except maybe from reinvested dividends.

Investors may choose from 24 model portfolios of mutual funds or 12 model portfolios of ETFs. Comparing for example NASDAQ vs. And among the institutional funds that are targeted for high-net-worth investors with millions to spare Balasa recommends JP.

The FTSE Nareit Equity REITs Index is a free-float adjusted market capitalization-weighted index of US. KOSPI performance year-to-day the former is up 25 while the latter is actually down 05. Even so many SMA programs have minimums that are well in excess of what you might find in a mutual fund.

40 FTSE Nareit Equity REITs Index 30 SP Global Infrastructure Index 30 SP Global Natural Resources Index. Large Cap TMLC sleeve of. Schwab Managed Accounts are for investors with a minimum.

Parametric has incorporated tax management into our clients custom direct indexing portfolios since 1992. Learn more about DIRECT indexing strategies. Tax-Managed Strategy key features.

Specific percentages will vary based on. Equity Index Strategy Net of Fees 448 1406 1862 1107 1402 1339 After-Tax Composite Benchmark Return 2 430 1383 1795 1020 1365 1269 The composite returns represent the asset-weighted performance of the Tax-Managed US. Has anyone used the Fidelity Tax-Managed US.

Since thenand in all market environmentsweve helped clients reduce tax exposure while preserving market exposures. What youll receive with the Fidelity Tax-Managed US. Fidelity Strategic Disciplines includes the Fidelity Tax-Managed International Equity Index Strategy.

We believe an active tax management strategy can improve investor outcomes. In the past year US market outperformed by far pretty much everything else including the Japanese Nikkei the Korean KOSPI and the EU DAX etc. In this case the main concern was minimizing the realization of the 13 million of unrealized gains embedded in the portfolio.

Our experts work side-by-side with you to build a personalized solution for your clients. Tax-managed funds enable investors to control when they realize capital gains such as during a low income tax period when their tax rates will be lowest. Ad Help Investors Seek Growth Income With Equity Income Funds.

The Tax-Managed Equity Growth Model Strategy seeks to provide on an after-tax basis high long-term capital appreciation. The SP Global Infrastructure Index provides liquid and tradable exposure. Its a separately managed account that requires a 200K minimum and charges an annual fee of 20-65 depending on assets.

It still requires a sufficient amount of capital to implement effectively even with fractional shares trading capabilities. Recently our tax-managed equity TME team worked with a wealth manager to transition a 3 million client portfolio comprising nine stocks into a well-diversified TME portfolio targeting the SP 1500 index portfolio. Morgans Institutional Tax-Aware Disciplined Equity DFA US.

We were also among the first to provide after-tax reporting and we update after-tax performance on a quarterly. Investors can use Tax-Advantaged Equity to seek an increase in long-term total returns through customized capital gain or loss realization strategies aggressive transaction cost management and proprietary risk management. The Strategic ETF Strategies are a straightforward inexpensive way to include equity and fixed-income ETFs in your portfolio.

The alleged advantage is that tax-harvesting improves after-tax return more than offsetting the fee. Moderate Tax-Efficient Bucket Portfolio. Potential for long-term growth This direct index strategy seeks to deliver the long-term growth potential of US.

Nov 3 2021. Fidelity Strategic Disciplines provides nondiscretionary financial planning and discretionary investment management for a fee. Morningstar broad category US Equity largemidsmall VBG which includes mutual funds and ETFs and multiple share classes.

These Strategies consist of strategic asset allocation models developed by SEIs Portfolio Strategy Group 1 that are generally comprised of exchange traded funds ETFs that attempt to achieve specific investment goals. 3 A portfolio tilt is an investment strategy that overweights a particular. Make use of layered tax management strategies including tax-efficient allocations after-tax portfolio.

Ad Your Clients GoalsOur Investment Solutions.

Fidelity Equity Income Strategy A Separately Managed Account Fidelity

A Look At The Road To Asset Parity Between Passive And Active U S Funds Morningstar

Separately Managed Accounts U S Large Cap Equity Fidelity

Fidelity Tax Managed Us Equity Index Strategy Fidelity

A Look At The Road To Asset Parity Between Passive And Active U S Funds Morningstar

A Look At The Road To Asset Parity Between Passive And Active U S Funds Morningstar

Fidelity Tax Managed Us Equity Index Strategy Fidelity

Horizons Etfs An Introduction To Horizons Total Return Index Etfs

0 comments

Post a Comment